Executive Summary

The end of March signals the end of the marketing year in most of Southern Africa. It also marks the end of the hunger season, and is characterized by the appearance of green maize and other seasonal food crops that become available at the household level as well as on rural markets. Although overall food security is improving as many households begin to access new seasonal crops; the situation is expected to remain worrisome in some parts of the countries that have been adversely affected by the poor crop growing conditions this season.

The 2004/05 season has been marked by adverse conditions including erratic rains, intermittent dry spells, and flooding in parts. These conditions were exacerbated by a mid season drought in some of the worst affected parts of southern and central Malawi, southern and central Mozambique, the southern half of Zambia, and most of Zimbabwe. This, together with reported low availability of agricultural inputs has led to reduced crop yields, which will translate into production shortfalls, especially for the maize crop. While the extent of shortages will vary across the different countries, FEWS NET advocates early planning both by national governments and the humanitarian and donor communities which will help avert any food crisis that may arise as a result of failed harvests. With a good harvest expected in South Africa and currently low prices for maize, early import planning is urged for those countries facing a national shortfall.

National vulnerability assessments, which will be fielded in April-May in Lesotho, Malawi, Mozambique, Swaziland, Zambia and Zimbabwe, will provide information that will form the basis for targeted interventions and other developmental strategies aimed at responding to the needs of the vulnerable and the food insecure. Most of the affected countries have requested (or are requesting) joint FAO/WFP crop and food supply assessment missions (CFSAM) to verify and validate demand and available supply and access data. The CFSAM missions have only been confirmed for Malawi and Mozambique - and these will take place end of April/ early May.

Season progress and production outlook

The rainfall across much of central part of Southern Africa has been poor during the 2004/2005 season, and especially in February and March, resulting in reduced crop yields across many areas. Areas that are negatively affected include much of Mozambique, southern and central Malawi, much of Zimbabwe, northern South Africa, southern Zambia, northern Namibia, and southern Angola. In contrast, the productive central areas of South Africa had good rains and are likely to have above-average crop performance this season. Figure1- the Water Requirements Satisfaction Index (WRSI) anomaly - shows the general effect that the rainfall distribution had on the performance of maize planted in the different parts of the region. Orange and purple colors indicate areas where the rainfall performance suggests below average crop performance, while the green colors show areas with potentially better than average performance. Grey indicates areas where average or normal crop performance is expected.

|

| Source: USGS/FEWS NET |

The WRSI models mainly the effect of rainfall distribution on crop performance assuming all other conditions remain constant. Where other important factors such as availability of inputs, crop pests and diseases, are significantly different from normal, these need to be taken into account to revise the crop expectations upwards or downwards as appropriate.

|

|

| Source: NOAA CPC |

Source: NOAA CPC |

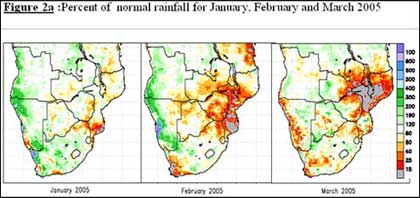

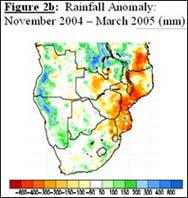

As the rainy season was drawing to a close in March, most areas received below normal rainfall (Figure 2a). Brown, red and grey colors indicate areas where below normal rainfall was received. Some of the areas that received low rainfall in March had already been affected by poor rains in February, which is the month during which adequate soil moisture is most critical for the development of cereal crops. Any rains that fall beyond this date in the affected areas will be beneficial for pasture and water availability, but will not benefit cereal crops that are affected beyond recovery. In those areas where rainfall performance has been satisfactory, further rainfall at this time in the season could actually adversely affect cereals as the added moisture in maturing grain would increase fungal diseases. Figure 2b depicts the overall precipitation since the start of the season: areas depicted in brown and red colors indicate those areas where total seasonal rainfall has been below normal, which is in line with the WRSI image in Figure 1.

Crop Production Outlook for the 2004/05 season

Unfavorable crop growing conditions (an erratic start to the season, intermittent dry spells, and the prolonged February dry spells), coupled with widespread problems of input availability and access, are likely to heighten food security concerns in the region during the 2005/06 season. Many, if not all of the hard hit areas were similarly affected by poor crop conditions last year, resulting in food production shortfalls that left many of the poorer and vulnerable households struggling to access adequate food. Another below average crop will have a serious impact on people's ability to cope with difficulties of continuing food access.

Angola:

Area planted to staple crops and subsequent production was expected to increase further in the 2004/05 season for a variety of reasons. Continued mitigation measures (by government and humanitarian agencies), such as provision of farm inputs to internally displaced persons (IDPs), coupled with good rains, have helped enhance production recovery prospects. Crop conditions in the Planalto regions are reported to be good, raising expectations of a better harvest this year compared to last year, when many farmers experienced crop losses as a result of flooding. The naca harvest in January is reported to have been good.

Botswana:

A below average harvest is expected as a result of reduced area planted, occasioned by delayed onset and the sporadic nature of the rains coupled with inadequate draft power (shortage of tractors and poor condition of oxen). Plowing and planting did not begin until after the widespread rains that fell during the first half of December. However, intermittent dry spells since then have severely affected crop development; the lack of soil moisture led to poor emergence, and necessitated replanting in some areas. By March, the crop was reported to range between vegetative and cobbing, and was mostly in poor condition. Preliminary forecasts from the Ministry of Agriculture suggest total cereal production of 17,729 MT which is down 46% from the 2003/04 harvest of 32,889 MT.

Lesotho:

A rapid assessment from 15 - 30 March carried out jointly by FAO, the Ministry of Agriculture and partners indicates below normal crop yields can be expected, with total cereal production estimated at 122, 300 MT, which is 14 percent below the last five year average, but is 19 percent above last year's very poor harvest of 102,900 MT. The report cautions however that this is a very preliminary forecast, as it is very early in the season to predict final yields accurately, and is based on the assumption that there will be no further yield reduction. The cereal crop was reported to have reached maturity in most parts of the country, and was generally in fair condition. Crops that have not reached maturity are likely however to be caught by the early frost, which sets in as early as the first week of April in the high-lying areas. Further yield reductions are therefore still possible.

Malawi:

The second round of production estimates (presenting preliminary forecasts) released on April 1st , indicates a marked drop from the end of January first round estimates. This is on account of the severe dry spells that were experienced over most of the country - but especially in the southern and central regions where it caught most of the maize crop at the tasseling and cobbing stage where adequate soil moisture is critical. Lack of access to fertilizers (as a result of scarcity, cost and untimely distribution) has also been cited as a major factor impacting negatively on crop yields. The maize crop is estimated to have dropped 24percent from 1.7 million (in January) to 1.3 million. The current estimate is also 25 percent below last year's maize harvest estimate of 1.73 million MT. Rice production is estimated at 54,700 MT (10 percent above last year); cassava is estimated at 2.4 million MT (7 percent below last year); sweet potato production is down 13 percent over last season, while groundnut production is estimated to have increased by 4 percent over last year only because of a 14 percent increase in area planted. An FAO/WFP crop and food supply assessment mission scheduled for April/May is expected to verify estimates and the extent of the likely shortfalls.

Mozambique:

The Ministry of Agriculture and Rural Development will be issuing the first harvest estimates in early April following assessments of the impact on national crop production of the inadequate and erratic rains in the south and central parts of the country as well as heavy rainfall received in the north, which caused localized inundations, especially along the Zambezi valley and its tributaries. The long dry spells in the south (particularly in Gaza and Inhambane provinces) have caused widespread crop failure and reduced yields of the more drought tolerant crops such as cassava. In the northern, and parts of central Mozambique; overall crop production is expected to be near normal. Current projections are that total cereal production will fall well below the 2003/04 total of 1.95 million MT. An FAO/WFP crop and food supply assessment mission is scheduled for April/May.

Namibia:

The national Early Warning Unit in the Ministry of Agriculture, Water and Rural Development has released its first crop forecast which indicates mixed production prospects across the northern crop growing regions. Overall, despite the erratic performance of the rains, the forecast points to a cereal harvest similar to that realized last year, and which at 129,300 MT is 28 percent above the five-year average. Prospects are generally good in the north central regions; while growing conditions have been unfavorable in Caprivi and Kavango, where cereal production is estimated to have dropped 34 percent and 16 percent respectively. As this is an early forecast (done in February), it assumes the continuation of favorable growing conditions through to the end of season. The second round of estimates will be issued after the May crop assessment.

South Africa:

The crop production outlook in South Africa remains good as a result of good rains received during the second half of the growing season. The National Department of Agriculture's Crop Estimates Committee (CEC) current estimate (23 March 2005) for area planted to maize stands at 3.34 million hectares (up 4 percent from last year's 3.2 million hectares); while production is up 17 percent at 11.39 million MT (from 9.71 million MT last year). Sorghum production is estimated to have dropped 21 percent to 293,350 MT (against 373,000 last year) as a result of a 22 percent drop in area planted. Preliminary assessments based on farmers' first intentions to plant winter crops indicate a 7 percent reduction (to 771,000 HA) in area planted to wheat over last year. Assuming average yields, a total wheat harvest of 1.6 million MT can be expected (against the 2004 harvest now estimated at 1.70 million MT).

Swaziland:

While most of the maize crop has matured and is in the drying stage there are some isolated areas of the country where the crop is already dry and awaiting harvest and others where it is still in vegetative stage. The intermittent dry spells experienced during the season coupled with heavy storms in parts have adversely affected crop yields, especially in the Lowveld, where crop failure was reported after the February dry spells. Preliminary forecast based on the Water Requirements Satisfaction model suggest a national maize crop of 67,000 MT, representing a 13 percent decrease over last year' WRSI model estimate of 77,000 MT, but a 5 percent above last year's FAO/WFP CFSAM estimate of 64,100 MT.

Tanzania:

Crops planted during the short season rains (vuli) in bimodal rainfall areas are now being harvested. Generally, the vuli season has performed poorly; especially in the northeastern regions where lack of adequate soil moisture led to stunting and permanent wilting in some areas. Nonetheless, cereal harvesting is on-going in the areas that have had satisfactory rains, while land preparation and acquisition of inputs is ongoing in readiness for the long rains (masika). Although the Climate Outlook for March - May suggests satisfactory crop growing conditions during the masika season, as rainfall is expected to be near normal; inadequate seed and agricultural labor availability may lead to a reduction in area planted. In the unimodal areas, where the crop is reported at vegetative stage; much of the crop that was adversely affected by dry conditions in the Dodoma, Mbeya, Ruvuma, Shinyanga and Tabora regions is expected to recover with the March rains, though final yields may be mediocre.

Zambia:

Prospects for another good harvest this season have been dampened by the poor performance of rains in the southern half of the country which affected the major grain producing areas of Central, Southern and Eastern Provinces. In particular, the maize production will experience significant reductions as a result of partial and complete crop failure in some parts. A rapid assessment in mid March by the Zambia VAC estimated crop failure rates in the affected areas that could range from 25 percent to as high as 95 percent (best case and worst case scenarios). The Ministry of Agriculture is currently conducting its forecast survey, and results are expected in early May. While Zambia projected a maize surplus of some 185,000 MT last season, and 200,000 MT in 2002/03; this season's production may not be enough to cover domestic requirements.

Zimbabwe:

Due to delayed onset of rains, the bulk of the maize crop was planted in the last two dekads of December, and by January was reported to be mostly at the vegetative stage. The dry spells in February and March coincided with the critical growth stages and have adversely affected the crop resulting in total crop failure in parts (especially in the southern provinces), while significantly lowering yields elsewhere. There is growing consensus that the 2004/05 food crop harvest will fall far short of domestic requirements, necessitating importation and assistance programs. The crop forecasting surveys, crop and food supply and vulnerability assessments planned for April/May by various stakeholders (including the Zimbabwe VAC) need to be fielded in a timely manner to enable effective planning.

Current food security and implications for 2005/06

The end of March signals the end of the marketing year in most SADC member States. It also marks the end of the hunger season, when fresh food crops become available for consumption at the household level and on rural markets. Although current food security overall is improving as many households begin to access new seasonal crops; the situation is expected to remain worrisome in those parts of the region that have been badly affected by the poor crop growing conditions this season. In the worst affected areas the situation may require some form of intervention as early as the end of June 2005.

Reports from the FEWS NET price monitoring survey in Angola indicate an improving food security situation in the Planalto regions (especially in Huambo) and Luanda. Markets continue to be well supplied with the main staple foods, and prices of beans and maize are reported to have dropped from the high levels recorded in December following the lowland (naca) harvest in January 2005. From January to March, the number of small-scale farmers supplying the markets increased, indicating that farmers are recovering from last year's poor harvests with the naca harvest reportedly better than last year. These reports also point to indications of good harvest prospects in May/June further enhancing the food supply situation in these areas.

In Lesotho and Swaziland, commercial import deliveries and ongoing food aid distributions have ensured continued availability of most staples and other basic food stuffs in both rural and urban areas and have contributed to the relative stability of prices. In addition, the availability of seasonal food crops and some green maize, especially in areas where rainfall performance was satisfactory, has also contributed to improve food supplies. Production prospects in both countries have again been compromised by unfavorable crop growing conditions, raising concerns of continued food shortages over the 2005/06 position. Vulnerability Assessment Committees in both countries will be undertaking in-depth national assessments from April 25 to May 7 to provide better understanding of the extent of the problem as well as underlying causes of both transitory and chronic food insecurity.

According to reports from Malawi, current indicators point to a temporarily stable food security situation; maize prices have remained stable, and maize is readily available in both local and ADMARC markets. In addition, an increasing number of households are once more depending on their own produced food, as the new crop becomes available for consumption. Despite the generally poor production prospects this season; the early planted crop was spared from the crippling effects of the February dry spells as it had already reached maturity. However only a small percentage of the maize crop (countrywide) was planted early. It is expected that the new crop being harvested will only provide a short respite for many households - with own food supplies running out as early as June for households in the most affected areas. The Malawi VAC will undertake a detailed assessment in April/May, which will indicate the extent of the impact on of the poor harvests on food security and livelihoods.

For much of the 2004/05 consumption year, poor households' access to food has remained a major concern in Zimbabwe, and a significant proportion of urban and rural households are finding it extremely difficult to purchase adequate amounts of food. Poor food access is mainly a factor of low income levels due to lack of employment opportunities coupled with high levels of inflation. Food security prospects for the 2005/06 consumption year are worrisome due to the projected poor 2004/05 harvest and the uncertainties around the government's ability to import the required food, given the prevailing precarious foreign currency situation. Timely assessments are required to ascertain the food security implications of the poor 2004/05 cropping season performance. Preparations are ongoing for the fielding of a vulnerability assessment by the Zimbabwe VAC in April/May.

Apart from the isolated locations that experienced a poor harvest last season, the food security situation over much of Tanzania remains satisfactory. Average maize prices in most major markets are reported lower this year compared to last year, making food more accessible to market dependent households. Following reports of deteriorating food security conditions in some isolated areas (parts of Arusha, Tanga, Manyara and Kilimanjaro regions), the Food Security Information Team conducted yet another rapid assessment between February 28 and March 11. The assessment results which should be out in April will provide a clearer indication of the extent of the problem and suggest possible interventions. The government is responding to current food access problems in affected districts through the release of more maize from the Strategic Grain Reserve, which is being distributed at subsidized prices to the targeted beneficiaries.

Despite the good harvest in Zambia last season, there have been reports of growing food insecurity in some of the western and eastern parts of the country. In response; the Zambia VAC carried out two rapid field verification exercises: one in January this year, covering western and eastern Zambia; and the second in February covering Samfya District in the north, where widespread flooding and displacement of persons was reported. The overall findings indicated that some 6,622 MT of food would be required to assist 340,758 beneficiaries between February and March 2005. However, there are concerns that while the food distribution (led by the Disaster Management and Mitigation Unit) will end in March, food security conditions in these areas may not improve after March, as many of the beneficiaries have been hard hit by adverse growing conditions this season, with many reporting crop failure. A rapid assessment by the Zambia VAC in mid-March (prompted by the widespread dry spells) has indicated that about two thirds of the country has been affected by the drought.

In Mozambique, current food availability and access are reported as adequate over most of the country, and this is evidenced by the comparatively low maize prices in the monitored markets. The Agricultural Market Information System (SIMA) reports declining maize prices in Gorongosa (central Sofala) and Chimoio and Manica, where the harvest is underway and the season has been relatively good. However, food shortages are expected to appear in the near future across southern and parts of central Mozambique, where the mid season drought that swept over these areas has led to widespread failure of the maize crop, and reduced the yields of other crops (such as cassava, beans and millets). Recent assessments indicate that shortages are likely to be most acute (and could appear as early as August) in the semi-arid interior of Gaza and Inhambane provinces, where the drought was most severe; and yet households rely more on maize production and alternative income opportunities are limited.

Regional trade flows and price movements

Informal Cross Border Trade

Over 120,000 MT of unofficial trade in maize, rice and beans in Mozambique, Malawi, Tanzania, Zambia, DRC and Zimbabwe have been captured over the past eight months through the WFP/FEWS NET informal cross border food trade monitoring initiative. As depicted in Figure 3, maize remains the most traded commodity, with 91,000 MT. Malawi is the major importer, having so far received close to 70,000 MT (or 75 percent of total trade) of maize, 93 percent of which is imported from Mozambique. Zimbabwe and DRC come in a distant second and third with 13 percent and 7 percent of the trade, respectively. Both countries obtained their imports almost entirely from Zambia. The volume of maize traded fell 15 percent in February to 9,500 MT, compared with the previous month's 11,300 MT. Volume of maize traded is expected to decline further in March due to dwindling on-farm stocks. Trade in rice and beans in February also fell from levels observed in January, and the total recorded trade since July now amounts to 15,000 MT and 14,800 MT respectively.

| Figure 3: |

|

| Source: FEWS NET and WFP Malawi and Cross Border Trade Steering Committee |

Poor harvest prospects for the 2004/05 season in parts of Malawi, Zambia, Zimbabwe and Mozambique may alter the maize trade flows over the 2005/06 marketing year. However, despite reduced harvests in Mozambique, it is expected that Malawi will continue to receive significant quantities of informal maize from Mozambique as current reports suggest that the areas of Zambezi province in Mozambique, which supply most of the maize for Malawi, have been less affected by the poor rainfall. Southern Malawi remains the primary market outlet for these surpluses due to vast distances and poor internal transportation to deficit areas within Mozambique. On the other hand, DRC and Zimbabwe could see reduced levels of informal maize trade with Zambia, especially if the export ban imposed in February is not lifted.

Maize Exports from South Africa remain low

For South Africa, despite the low maize prices prevailing since December, exports have been quite slow. The South Africa Grain Information Service (SAGIS) records indicated that of the exportable surplus of over 2 million MT, a total of 653,940 MT (596,532 MT white and 57,408 MT yellow) had been exported since May 2004. Zimbabwe remains the largest recipient, having imported some 165,000 MT of white maize, followed by Kenya, with close to 121,000 MT. Botswana, Lesotho, Namibia and Swaziland (BLNS), have together imported a total of 298,851 MT, a total that is far below the 410,000 MT that was estimated for export to these countries over this marketing year. Other SADC recipients include: Angola (23,975 MT) and Mozambique (41,948 MT). According to the maize supply and demand estimates by Grain SA, a total of 750,000 MT of maize were projected to be exported over the 2004/05 marketing year. With only two months left to the marketing season, which starts in May, it is unlikely that these targets will be reached. The strong South Africa Rand (R6.00 to the US$ in March) is contributing to the sluggish export trade. The existence of other surpluses from the 2003/04 production in Tanzania, Zambia and Mozambique contributed to the slow movement of surplus maize out of South Africa. For example, Malawi has not imported any maize from South Africa; but its informal imports from Mozambique are reported to have been in excess of 65,000 MT.

Zambia bans maize exports

Available data from Zambia indicates that the pace of exports of surplus maize stocks built up over the past two marketing seasons has been slow due to inadequate market arrangements. Although an estimated surplus over 185,000 MT was projected at the beginning of 2004/2005 crop marketing season; available data (though incomplete) suggests that just over a third (75,000 MT) of the declared surplus has been exported. At the end of February, available records indicated formal exports amounting to 35,000 MT and 20,000MT to Malawi and Zimbabwe respectively, while informal exports were indicated at 20,000 MT (about 12,000 MT to Zimbabwe, 6,000 MT to DRC and 2,000 MT to Malawi).

Meanwhile, due to fears of a poor maize harvest in the 2004/05 production season as a result of several factors including erratic rainfall, the Zambian Government has imposed an export ban on maize pending a full assessment of the situation. While full records of exports are not available, it is likely that carryover stock at the beginning of this marketing year (2005/06) will be quite substantial and will boost domestic availability and reduce any food gaps that may arise due to failed harvests. FEWS NET Zambia estimates that under a best case production scenario, domestic availability will be almost adequate to meet requirements leaving minimal import requirements. However the situation will become clearer once the crop forecast becomes available in May.

Retail maize price movements

Retail maize prices increased over February levels in the monitored markets of Zambia and Zimbabwe, but fell in Mozambique and Angola and maintained February levels in Malawi and Tanzania. The month of March saw a marked increase in average prices in Zambia from US$0.21/kg to US$0.23/kg, reflecting dwindling surplus stocks and the poor harvest expectations as a result of widespread dry spells, especially in the maize producing provinces. Last year's surplus has helped to contain price hikes this season; but the prospect of crop failure will exert pressure on prices keeping them up beyond the expected end of the hunger season, due to unavailability of the "green" harvest to augment food supplies. The highest increases were recorded in Zimbabwe in Bulawayo, where prices rose 50 percent from US$0.22/kg in February to US$0.32/kg, bringing the Zimbabwe average retail price (Harare and Bulawayo) to US$0.30/kg (or 30 percent above February levels). Prices are likely to remain high due to poor harvest prospects countrywide.

| Figure 4: |

|

| Source: FEWS NET Angola, Malawi, Mozambique, Tanzania, Zambia and Zimbabwe |

Maize prices in Malawi (averaged across Chitipa, Mchinji and Nsanje) remained stable from February to March, maintaining the US$0.14/kg level; while a similar trend was observed in Tanzania as a result of stable food supplies. The average (Dar es Salaam, and Mbeya) remained at US$0.12/kg. In Mozambique, the new harvest coming in from the central and northern provinces, and the release of old stocks have improved maize availability thus stabilizing prices which had been rising steeply since December (especially in Maputo). The average price (Maputo, Beira and Nampula) dropped from US$0.22/kg in February to US$0.21/kg in March. Retail maize prices in the Planalto region of Angola (recorded in Huambo Province) continue to decline markedly as food supplies improve. The average price dropped 23 percent to US$0.37/kg (US$0.48/kg in February). Prices are expected to decline further as availability continues to improve and with expectations of a good May/June harvest.

Maize prices on the South African Futures Exchange remain low

White maize prices on the South African Futures Exchange (SAFEX) stabilized in March, averaging R539/MT (R537/MT in February), but still remained 45 percent below the November 2004 high point of R974/MT. The same factors - expectations of a South African harvest now estimated at 11 million MT for the 2004/05 season, relatively low international maize prices (Argentina at US$85/MT and US Gulf at US$98/MT, and expected large carryover stocks (now in excess of 3 million MT) - continue to exert a downward pressure on local maize prices. The March average for yellow maize actually dropped further (to R608/MT from R646/MT in February). Monthly average prices (especially for white maize) continue to move towards export parity: in March Grain SA calculated these at R514/MT for white maize and R417/MT for yellow maize. Expectations are that prices on SAFEX will remain low over the next few months.

|